Explain the Different Types of Assessment in Gst

As per the Central Goods and Services Tax Act 2016 it is the centralized part of. One must note that there are basically three types of GST.

What Is Cmp 08 Check Its Format And Consequences Of Not Filing It On Time Https Www Mastersindia Co Gst Form Gst Cmp 08 Cmp Form Simple Words Finance

Types of Income Tax Assessment.

. Also it contributes to the final marks given for the unit. Under Income Tax Act 1961 there are four types of assessment as mentioned below. GST being subsumed service tax and central excise duty levies tax on the concept of supply.

The taxation rate under each of them is different. In this article the meaning of the term supply and the types of various supplies are discussed for the information of the readers. These are conducted at the end of units.

And similarly forms to apply for a practitioner are named as GST PCT-1 GST PCT-2 etc. Forms of Summary Assessment Sec 63 GST Form Number Description Rule FORM GST ASMT-16 Summary of Assessment Order Rule 1003 FORM GST ASMT-17 Application for Withdrawal of the Summary Assessment Order Rule 1004 FORM GST ASMT-18 Rejection of the Application for Withdrawal Rules 1005. The logic and dependability of summative assessment are of great importance.

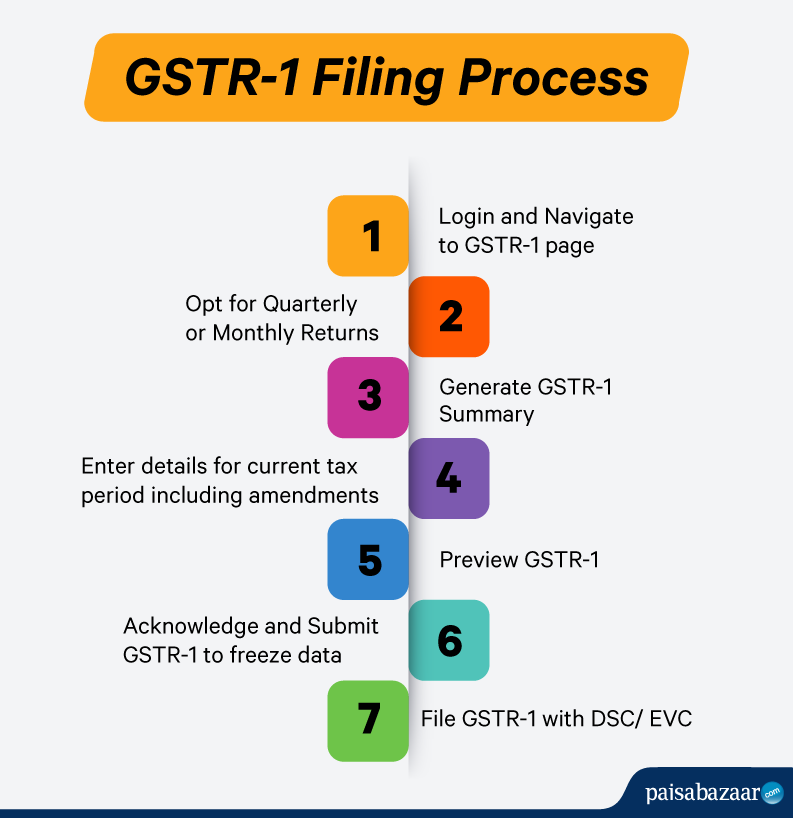

Form example all the forms for return filing will are named as GSTR-1 GSTR-2 etc. ¾ Central Goods and Service Tax CGST ¾ State Goods and Service Tax SGST ¾ Union Territory Goods and Service Tax UTGST ¾ Integrated Goods and Service Tax IGST. Self-assessment us 140A.

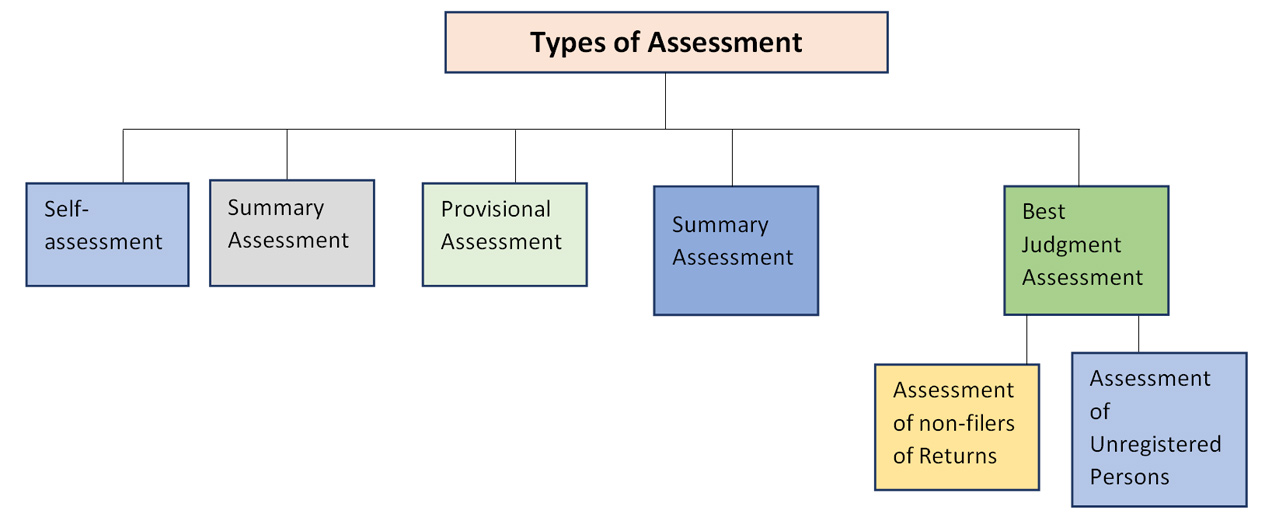

Return For Registered Person Whose GST Registration Gets. The form naming system under GST is impressive. The different types of assessment under GST Law are as under.

Section 60 of CGST Act Provisional assessment Provisional Assessment Order Section 61 of CGST Act Scrutiny of tax returns filed by registered taxable persons. Types of Assessment. Re-assessment or Income Escaping Assessment us 147.

THERE ARE FOUR TYPES OF GST. Types of assessment under GST 1 Self-Assessment section-59 2 Provisional Assessment Section-60 3 Scrutiny of Returns Section-61 4 Assessment of non-fillers of return Section-62 5 Assessment of unregistered. Annual Return For E-Commerce Operators Collecting TCS.

There are Four GST types namely Integrated Goods and Services Tax IGST State Goods and Services Tax SGST Central Goods and Services Tax CGST and Union Territory Goods and Services Tax UTGST. Individual Partnership Firm HUFCompanies AOP BOI etc. There are 5 types of assessments under GST-31 Self-Assessment Taxpayer does this kind of assessment himself to furnish taxes for the relevant tax period.

Re-assessment or Income escaping assessment us 147. Self assessment us 140A. Annual Return For Composition Dealers.

All these can be further categorized into. Assessment in case of search. It is mandatory for the person to determine the tax liability based on self-assessment and to pay the tax while filing return under GST.

The key word that is to be remembered by the stakeholders is supply. GSTR 9. Annual Return For Normal Registered Taxpayer Under GST.

It meansdetermination of tax liability under this Act and includes self-assessment re-assessment provisional assessment summary assessment and best judgment assessment. In Addition it provides data for selection for the next level. It shows the amount of learners success in meeting the assessment.

For Individual HUFthere is further classification of Residents into. There are various types of assessments which we shall discuss briefly in this post. CGST-Central Goods and Services Tax is applicable on the goods and services which are considered to be standard and tax rates can be amended periodicallyAll the revenue collected is allocated to the central government.

In case a registered dealer is unable to determine his tax liability on his own he can request a GST Tax officer to assess his tax and that tax officer can allow the taxpayer to pay. We know that there are different types of assessees like. They have named forms in such a simple manner that understanding nature of form becomes easy.

Summary assessment us 1431 Scrutiny assessment us 1433 Best Judgment Assessment us 144. Summary Assessment us 1431 Scrutiny Assessment us 1433 Best Judgment Assessment us 144. The new indirect tax regime under the Goods and Services Tax GST which was rolled out on 1 July 2017 had.

Return For Registered Persons Getting Accounts Audited From CA. Section 59 of CGST Act Self assessment of taxes payable.

Assessment Under Gst Types Procedures Indiafilings

Different Types Of Assessment Under Gst

Taxation Gst Impact On Common People Indirect Tax Tax Services Goods And Services

Frequent Tips To Set Up Online Travel Business Online Travel Business Travel Travel Industry

Parts Of An Ecosystem Consumers Learning Package Doodle Notes Ecosystems Create Your Own Comic

Checking Accounts Bank Reconciliation Statement Assessments And Worksheets Reconciliation Accounting Checking Account

What Is Professional Tax Legal Services Tax Tax Accountant

4 Type Of Market Research Market Research Quantitative Research Marketing

Different Types Of Assessment Under Gst

Different Types Of Assessment Under Gst Online Gst Return Filing

Good Days Gst Cargo365cloud Day Good Day Best

Different Types Of Assessment Under Gst Online Gst Return Filing

Gst Return Filing In Bangalore 1 Gst Return Filing Gst Return Services Bangalore Goods And Services Registration Billing Software

One Person Company In 2020 Appreciation Letter Goods And Service Tax Indirect Tax

Income Tax Refund Mail Tax Refund Income Tax Messages

Comments

Post a Comment